Use the following information to answer the following questions.

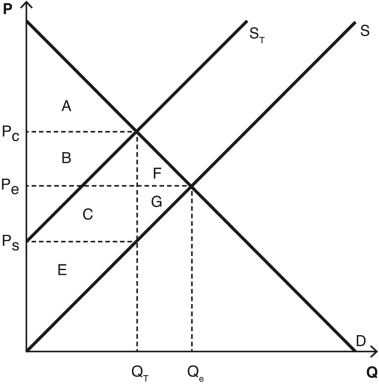

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which party is responsible for paying this tax out of pocket?

Definitions:

Sphygmomanometer

A device used to measure blood pressure, comprising a cuff to restrict blood flow and a manometer to measure the pressure.

Arterial Blood Pressure

The force exerted by circulating blood upon the walls of the arteries.

Breath Sounds

The sounds made by air as it moves through the respiratory system, which are auscultated with a stethoscope by a healthcare provider during a physical examination.

ECG

Electrocardiogram, a test that measures the electrical activity of the heart to identify various heart conditions.

Q2: In a market where supply and demand

Q5: When two goods are complements to each

Q24: A 15 percent increase in the price

Q38: When the price of an hour of

Q42: If the price of pants increases,what would

Q51: Which of the following is an example

Q87: While there are many pizza places in

Q89: Consider two labor markets.In the first,the elasticity

Q156: Of the following items,which is/are most important

Q175: What needs to be done to ensure