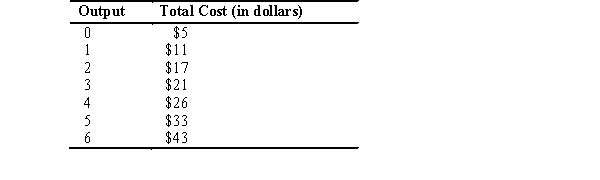

A firm sells its output in a competitive market.The firm's total cost function is given in the accompanying schedule:

The market price is $7 per unit.

The market price is $7 per unit.

a.What is the firm's profit-maximizing output level?

b.Is the industry in long-run equilibrium? Explain.

Definitions:

Equivalent Interest Rate

An interest rate that, when considering compounding and other factors, is effectively equal to a comparative rate.

Missing Interest Rate

The interest rate that is not specified or needs to be determined in a financial equation or scenario.

Equivalent Interest Rate

A rate that reflects the actual annual cost of a loan or the earnings on an investment, taking into account the effect of compounding.

False Consensus Effect

A psychological bias where individuals believe their own viewpoints, actions, and behaviors are more common in the general population than they actually are.

Q26: What does it mean to be a

Q27: A big difference between a competitive firm

Q33: The movie You've Got Mail features a

Q38: Which of the following is characteristic of

Q54: Pawkeepsie Groomers' short-run supply curve would be

Q73: What will be the amount of EJH

Q90: Externalities are minimized if<br>A) private property rights

Q110: Which of the curves depicts economies of

Q152: If Boston Batting Cages received $80,000 in

Q157: A firm would produce in the long