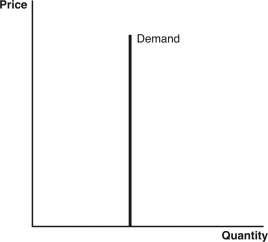

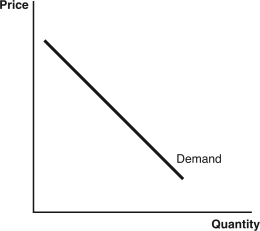

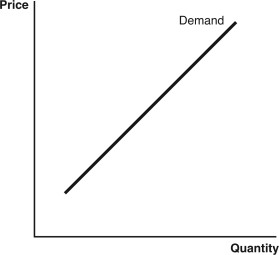

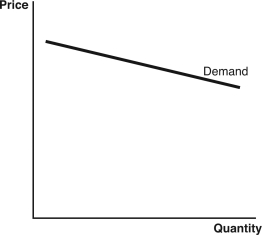

Use the following graphs to answer the following questions:

A.

B.

B.

C.

C.

D.

D.

E.

E.

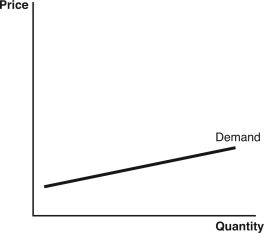

-Which graph best describes the demand for an elective surgery that is so price sensitive that doctors have to issue coupons to get more patients?

Definitions:

Fixed Manufacturing Overhead

Costs that remain constant regardless of the level of production or sales volume, such as salaries of supervisors and rent for factory premises.

Fixed Manufacturing Overhead

Indirect manufacturing costs that remain relatively constant regardless of the volume of production, including costs like factory rent, salaries of supervisors, and depreciation of factory equipment.

Direct Labor

The cost of wages for labor directly involved in the production of goods or services.

Raw Material

Basic materials and substances used in the initial stages of production to create goods and services.

Q4: What creates the "broken" tulip,so highly valued

Q30: For Ivett to be willing to play

Q44: What are fixed amounts that the insured

Q64: Utility theory seeks to measure<br>A) supply.<br>B) costs.<br>C)

Q71: The field of economics that draws on

Q94: The federal government has recently decided to

Q108: How much money would a risk-neutral student

Q113: What would be the consequence for insurance

Q137: Which of the following is one of

Q152: Even after reaching an insurance policy's deductible,some