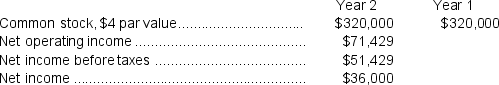

Uhri Corporation has provided the following data:  Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $6.08 per share.The company's dividend payout ratio for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $6.08 per share.The company's dividend payout ratio for Year 2 is closest to:

Definitions:

Recognized Gain

An increase in the value of an asset that has been sold or deemed to have increased in value officially on financial statements.

Selling Price

The amount for which a product or service is sold, not necessarily equal to the cost or intrinsic value of the item.

Carrying Value

The book value of an asset or liability on a company's balance sheet, calculated as the original cost minus depreciation or amortization.

Intra-Entity Inventory Sales

Sales transactions of inventory between divisions or subsidiaries within the same parent company, not affecting consolidated financial results until sold externally.

Q8: Which of the structures below corresponds to

Q28: Byerly Corporation has provided the following data

Q29: (Ignore income taxes in this problem.)Welch Corporation

Q30: Balance the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3244/.jpg" alt="Balance the

Q52: Ignoring any salvage value, to the nearest

Q65: Which of the following would be classified

Q84: Tomlin Corporation prepares its statement of cash

Q97: Consider an electrochemical cell with the

Q99: The simple rate of return for the

Q105: Negative free cash flow does not automatically