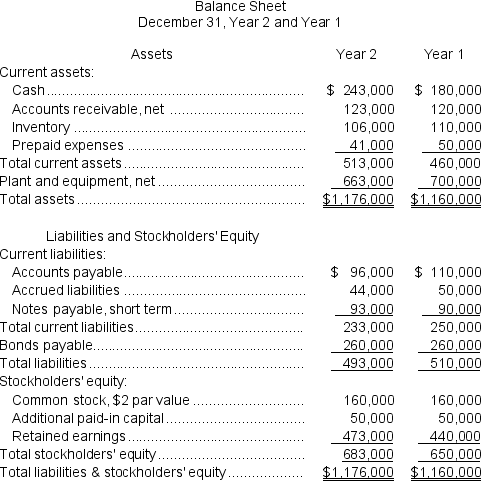

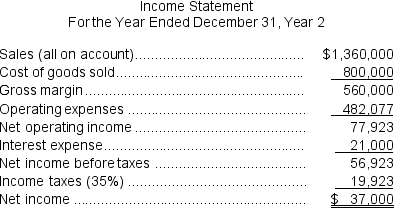

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $5.75 per share.

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $5.75 per share.

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's accounts receivable turnover for Year 2?

e.What is the company's average collection period for Year 2?

f.What is the company's inventory turnover for Year 2?

g.What is the company's average sale period for Year 2?

h.What is the company's operating cycle for Year 2?

i.What is the company's total asset turnover for Year 2?

j.What is the company's times interest earned ratio for Year 2?

k.What is the company's debt-to-equity ratio at the end of Year 2?

l.What is the company's equity multiplier at the end of Year 2?

m.What is the company's net profit margin percentage for Year 2?

n.What is the company's gross margin percentage for Year 2?

o.What is the company's return on total assets for Year 2?

p.What is the company's return on equity for Year 2?

q.What is the company's earnings per share for Year 2?

r.What is the company's price-earnings ratio for Year 2?

s.What is the company's dividend payout ratio for Year 2?

t.What is the company's dividend yield ratio for Year 2?

u.What is the company's book value per share at the end of Year 2?

Definitions:

Dimension of Personality

Fundamental traits or characteristics that make up an individual's personality, often used in psychology to analyze and understand human behavior.

Core Self-evaluation

A broad personality concept that reflects individuals' fundamental assessments of themselves, their abilities, and their control over their environment.

Emotional Stability

A personality trait characterized by the capability of handling stress, maintaining calmness, and not frequently experiencing negative emotions.

Conscientiousness

A characteristic of personality that involves being organized, reliable, and having a significant commitment to responsibilities.

Q5: A project requires an initial investment of

Q6: The opportunity cost of making a component

Q18: Under the direct method of determining the

Q32: (Ignore income taxes in this problem.)Boxton Corporation's

Q41: Which of the following statements about the

Q52: In passing through matter, alpha particles lose

Q123: The accounts receivable turnover for Year 2

Q169: (Ignore income taxes in this problem.)Devon Corporation

Q177: The present value of the annual cost

Q287: Broch Corporation's income statement appears below: <img