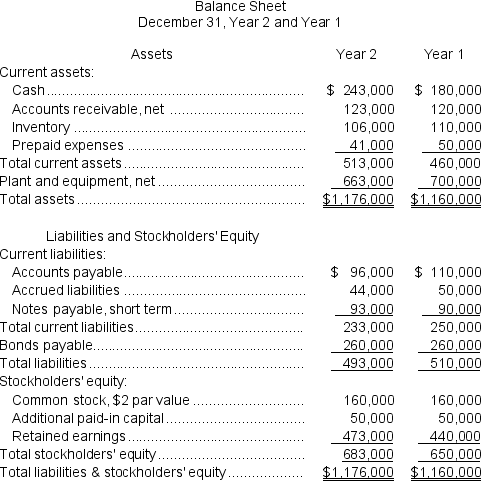

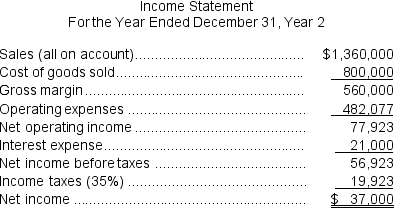

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $5.75 per share.

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $5.75 per share.

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's accounts receivable turnover for Year 2?

e.What is the company's average collection period for Year 2?

f.What is the company's inventory turnover for Year 2?

g.What is the company's average sale period for Year 2?

h.What is the company's operating cycle for Year 2?

i.What is the company's total asset turnover for Year 2?

j.What is the company's times interest earned ratio for Year 2?

k.What is the company's debt-to-equity ratio at the end of Year 2?

l.What is the company's equity multiplier at the end of Year 2?

m.What is the company's net profit margin percentage for Year 2?

n.What is the company's gross margin percentage for Year 2?

o.What is the company's return on total assets for Year 2?

p.What is the company's return on equity for Year 2?

q.What is the company's earnings per share for Year 2?

r.What is the company's price-earnings ratio for Year 2?

s.What is the company's dividend payout ratio for Year 2?

t.What is the company's dividend yield ratio for Year 2?

u.What is the company's book value per share at the end of Year 2?

Definitions:

Illegal

Something that is forbidden by law or statute, involving penalties upon violation.

United States

A country located primarily in North America, consisting of 50 states and a federal district, known for its diverse culture and significant influence on global affairs.

Cybersex

A virtual sexual encounter between individuals via the internet, using text or multimedia.

Anonymous

Referring to someone or something without a known identity, often used to describe actions or statements made without revealing one's identity.

Q5: The following events occurred last year for

Q26: Which nitrogen base is found in RNA

Q45: The total number of electrons in the

Q45: An investment project with a project profitability

Q64: Which of these square planar complex ions

Q83: (Ignore income taxes in this problem.)Choudhury Corporation

Q87: (Ignore income taxes in this problem.)Ostermeyer Corporation

Q87: Negative free cash flow suggests that the

Q104: The company's average sale period for Year

Q123: The accounts receivable turnover for Year 2