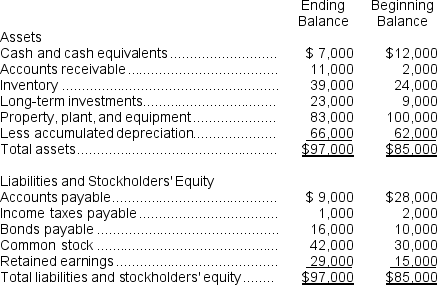

Alden Corporation's most recent comparative Balance Sheet is as follows:  Alden's net income was $34,000.No equipment was purchased and no long-term investments were sold.There was a gain of $3,000 when equipment was sold.The accumulated depreciation on the equipment that was sold was $12,000.Cash dividends of $20,000 were declared and paid during the year.

Alden's net income was $34,000.No equipment was purchased and no long-term investments were sold.There was a gain of $3,000 when equipment was sold.The accumulated depreciation on the equipment that was sold was $12,000.Cash dividends of $20,000 were declared and paid during the year.

Required:

Prepare Alden's statement of cash flows using the indirect method.

Definitions:

Fixed Assets

Long-term tangible assets used in operations, such as machinery, buildings, and equipment, which are not expected to be converted into cash in the short term.

Sales Capacity

The maximum level of sales that a company can achieve within a given period under normal operating conditions.

Projected Sales

An estimate of the amount of sales that a company expects to achieve in a future period.

External Financing Needed

The amount of money a company must raise from external sources to finance its business activities or growth, beyond what it can generate internally.

Q10: Sand Company has an acid-test ratio of

Q42: When a <sup>87</sup>Br nucleus emits a beta

Q47: (Ignore income taxes in this problem.)Crowl Corporation

Q76: (Ignore income taxes in this problem.)Bill Anders

Q120: Financial measures such as ROI and residual

Q136: Banfield Corporation makes three products that use

Q157: Maraby Corporation's average collection period for Year

Q165: (Ignore income taxes in this problem.)Nevland Corporation

Q215: Wegener Corporation's most recent balance sheet and

Q223: As the inventory turnover increases, the average