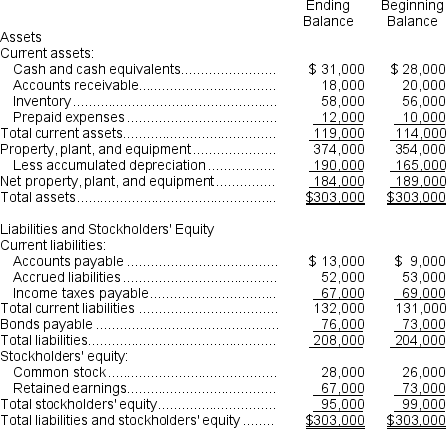

Krech Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

Definitions:

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenues, indicating the company's actual profit.

IFRS

Worldwide, the International Financial Reporting Standards serve as the accounting framework for drafting financial statements.

Single-Step Approach

A simple method of presenting an income statement where all revenues are summed in a single step before subtracting all expenses to find the net income.

Multiple-Step Approach

An income statement preparation method that highlights several steps or stages in determining net income, including operating and non-operating sections.

Q11: The secondary structure of a protein is

Q40: Sales reported on the income statement totaled

Q51: The use of return on investment (ROI)as

Q70: Tritium is a radioisotope of hydrogen having

Q81: Tritium is a radioisotope of hydrogen having

Q93: Last year Javer Corporation had net income

Q115: A project has an initial investment of

Q116: If the salvage value of equipment at

Q124: A cost that is assigned to a

Q216: Sidell Corporation's most recent balance sheet and