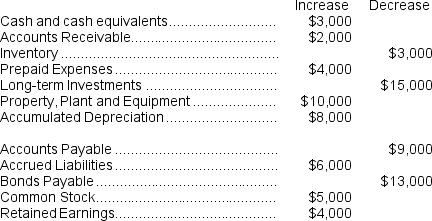

(Appendix 14A) The change in each of Kendall Corporation's balance sheet accounts last year follows:

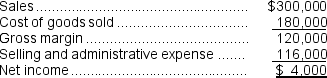

Kendall Corporation's income statement for the year was:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

-Using the direct method,sales adjusted to a cash basis would be:

Definitions:

Tax Exempt

Describes income, property, or transactions that are legally free from tax liability.

Common Equity

The amount of ownership in a corporation that is held by common shareholders, represented by the value of common stock plus retained earnings.

Year-end Balance Sheets

Financial statements detailing a company's assets, liabilities, and equity at the end of a fiscal year.

Retained Earnings

Profits that a company retains rather than distributes to its shareholders as dividends, often used for reinvestment.

Q1: The company's operating cycle for Year 2

Q16: Consistency demands that a cost that is

Q28: The net cash provided by (used in)operating

Q53: If the internal rate of return is

Q121: Excerpts from Deblois Corporation's comparative balance sheet

Q123: Which product makes the LEAST profitable use

Q145: If a company contains a number of

Q155: Worsell Inc.reported the following results from last

Q197: Data from Ben Corporation's most recent balance

Q227: The average sale period for Year 2