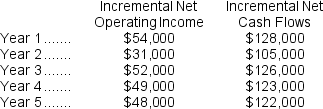

(Ignore income taxes in this problem.) Vandezande Inc. is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are:

Assume cash flows occur uniformly throughout a year except for the initial investment.

Assume cash flows occur uniformly throughout a year except for the initial investment.

-If the discount rate is 10%,the net present value of the investment is closest to:

Definitions:

Holding Cost Rate

The percentage of the value of inventory held over a certain period of time as costs, including storage, insurance, and depreciation.

Economical

Characterized by efficiency and avoidance of waste, referring to the cost-effective allocation and use of resources.

Keiretsu

A closely linked alliance of businesses in Japan, often including manufacturers and suppliers, which cooperate to ensure mutual success.

Net Profit Margin

A financial metric that calculates the percentage of net profits earned with respect to sales revenue, indicating the efficiency of a company in converting sales into actual profits.

Q20: Excerpts from Neuwirth Corporation's comparative balance sheet

Q21: Pascarelli Corporation's inventory at the end of

Q32: The net cash provided by (used in)operating

Q42: Adah Corporation prepares its statement of cash

Q46: Paine Corporation processes sugar beets in batches

Q63: Alden Corporation's most recent comparative Balance Sheet

Q105: If the company pursues the investment opportunity

Q119: A revenue variance is favorable if the

Q170: Sunk costs are costs that have proven

Q189: Consider the following production and cost data