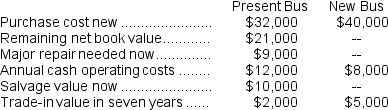

(Ignore income taxes in this problem.) Morrel University has a small shuttle bus that is in poor mechanical condition. The bus can be either overhauled now or replaced with a new shuttle bus. The following data have been gathered concerning these two alternatives:

The University could continue to use the present bus for the next seven years. Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years. The University uses a discount rate of 12% and the total cost approach to net present value analysis.

The University could continue to use the present bus for the next seven years. Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years. The University uses a discount rate of 12% and the total cost approach to net present value analysis.

-If the present bus is repaired,the present value of the annual cash operating costs associated with this alternative is closest to:

Definitions:

Long-term Debt

Loans and financial obligations lasting more than one year that a company owes to external parties.

Contingent Liability

A potential liability that may become an actual liability in the future.

Warranty Expense

Costs associated with the obligation to repair or replace a product due to defects for a specified period.

Bad Debt Expense

An expense account to record uncollectible receivables.

Q7: The profitability index of investment project D

Q33: Wallen Corporation is considering eliminating a department

Q111: Last year's return on investment (ROI)was closest

Q116: Cash equivalents on the statement of cash

Q120: Financial measures such as ROI and residual

Q126: Illies Corporation's comparative balance sheet appears below:

Q126: Schickel Inc.regularly uses material B39U and currently

Q140: Mondok Corporation has provided the following financial

Q145: If a company contains a number of

Q189: Consider the following production and cost data