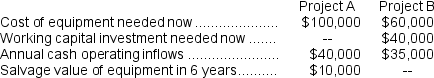

(Ignore income taxes in this problem.) Lambert Manufacturing has $100,000 to invest in either Project A or Project B. The following data are available on these projects:

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's required rate of return is 14%.

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's required rate of return is 14%.

-The net present value of Project A is:

Definitions:

Deadweight Loss

A loss of economic efficiency that can occur when the free market equilibrium for a good or a service is not achieved.

Cable Television

A system that delivers television programming through coaxial or fiber-optic cables directly to viewers.

Lump-Sum Payment

A one-time payment made for a particular item or service, rather than payments spread over time.

Monopsony Power

A market condition where there is only one buyer, giving them the power to influence prices and terms.

Q10: The present value of a cash flow

Q36: If accounts receivable increase during a period,

Q40: The company's net cash provided by (used

Q41: The net cash provided by (used in)investing

Q51: On the statement of cash flows, the

Q59: The payback period is closest to:<br>A)3.33 years<br>B)3.0

Q111: Last year's return on investment (ROI)was closest

Q129: The company's average collection period for Year

Q152: If the net present value of a

Q178: If management decides to buy part Z43