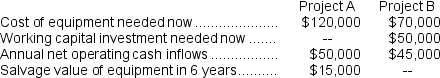

(Ignore income taxes in this problem.) Lambert Manufacturing has $120,000 to invest in either Project A or Project B. The following data are available on these projects:

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

-The net present value of Project A is closest to:

Definitions:

Separation Anxiety

A disorder characterized by excessive fear or anxiety about separation from home or an attachment figure.

Emotional Development

The process of learning to recognize, express, and manage emotions from infancy through adulthood.

Pride

A feeling of self-respect and personal worth, often accompanied by satisfaction derived from one's own achievements or the achievements of those with whom one is closely associated.

Humility

A modest or low view of one's own importance that emphasizes the value of others and openness to new perspectives or learning.

Q12: (Ignore income taxes in this problem.)You have

Q24: Brew Corporation's most recent comparative balance sheet

Q30: One way to increase the effective utilization

Q36: If the present bus is repaired, the

Q83: (Ignore income taxes in this problem.)Choudhury Corporation

Q119: The company's return on total assets for

Q122: The net cash provided by (used in)investing

Q125: Excerpts from Candle Corporation's most recent balance

Q143: (Ignore income taxes in this problem.)Bau Long-Haul,

Q240: The company's return on equity for Year