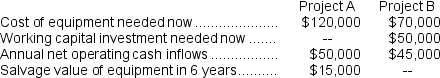

(Ignore income taxes in this problem.) Lambert Manufacturing has $120,000 to invest in either Project A or Project B. The following data are available on these projects:

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

-The net present value of Project B is closest to:

Definitions:

Psychological Factor

An element of human psychology that influences thoughts, feelings, and behaviors.

Etiology

The study of the causes or origins of disease or abnormal conditions, including factors contributing to the development of diseases.

Diathesis-Stress Model

A psychological theory that explains behavior as a result of a predispositional vulnerability together with stress from life experiences.

Biopsychosocial Approach

A comprehensive model that attributes health and illness to the combination of biological, psychological, and social factors.

Q34: The manufacturing cycle efficiency (MCE)was closest to:<br>A)0.09<br>B)0.12<br>C)0.67<br>D)0.04

Q50: The ROI for this year's investment opportunity

Q56: Which of the following is correct regarding

Q95: Based solely on the information above, the

Q97: A change in sales has no effect

Q98: Suppose Deed Corporation evaluates managerial performance using

Q102: The net cash provided by (used in)investing

Q155: Prosner Corp.manufactures three products from a common

Q174: The delivery cycle time was:<br>A)19.2 hours<br>B)20.6 hours<br>C)8.3

Q272: Rubendall Corporation's total current assets are $310,000,