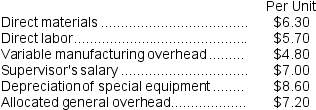

Part S51 is used in one of Haberkorn Corporation's products.The company makes 12,000 units of this part each year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $37.70 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided. The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

An outside supplier has offered to produce this part and sell it to the company for $37.70 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided. The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

Definitions:

Specifying Asset Classes

The process of identifying distinct categories of assets, such as stocks, bonds, and real estate, based on their characteristics and functions in investment portfolios.

Capital Market Expectations

The forecasted future returns, volatilities, and correlations for the major asset classes, which are essential for the strategic asset allocation process.

Investment Objectives

Define the financial goals and strategies of an investor or an investment fund.

Risk

The potential for loss or unfavorable outcomes in any given situation, often assessed in finance as the variability of returns on investments.

Q13: (Ignore income taxes in this problem.)You have

Q25: (Ignore income taxes in this problem.)Gallatin, Inc.,

Q30: (Ignore income taxes in this problem.)Bradley Corporation's

Q39: The net operating income for Year 1

Q58: Shoshoni Corporation prepares its statement of cash

Q101: In a special order situation that involves

Q111: Burns Corporation's net income last year was

Q126: Schickel Inc.regularly uses material B39U and currently

Q156: What is the financial advantage (disadvantage)for the

Q176: The division's net operating income last year