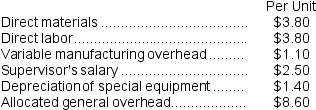

Rebelo Corporation is presently making part E07 that is used in one of its products.A total of 17,000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $20.80 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part E07 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to make and sell the part to the company for $20.80 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part E07 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

Definitions:

Whistle-Blowers

Individuals who expose illegal, unethical, or improper conduct within an organization, often facing significant personal risk.

Socioeconomic View

A perspective that considers both social and economic factors when analyzing situations or phenomena.

Profit

The financial gain obtained when the revenues generated from business activities exceed the expenses, taxes, and costs involved in maintaining the business.

Corporate Charity

Refers to the donations and philanthropic activities undertaken by a company in support of various social, environmental, or community issues.

Q4: Are the materials costs and processing costs

Q4: Kuma, Inc.had cost of goods sold of

Q7: The net cash provided by (used in)operating

Q16: Queue time is considered non-value-added time.

Q39: The net cash provided by (used in)financing

Q51: The use of return on investment (ROI)as

Q68: (Ignore income taxes in this problem.)Ducey Corporation

Q80: Basey Corporation has provided the following data

Q81: Last year's return on investment (ROI)was closest

Q156: An advantage of using ROI to evaluate