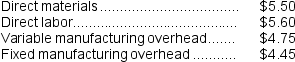

The SP Corporation makes 40,000 motors to be used in the production of its sewing machines.The average cost per motor at this level of activity is:  An outside supplier recently began producing a comparable motor that could be used in the sewing machine.The price offered to SP Corporation for this motor is $18.If SP Corporation decides not to make the motors, there would be no other use for the production facilities and none of the fixed manufacturing overhead cost could be avoided.Direct labor is a variable cost in this company.The annual financial advantage (disadvantage) for the company as a result of making the motors rather than buying them from the outside supplier would be:

An outside supplier recently began producing a comparable motor that could be used in the sewing machine.The price offered to SP Corporation for this motor is $18.If SP Corporation decides not to make the motors, there would be no other use for the production facilities and none of the fixed manufacturing overhead cost could be avoided.Direct labor is a variable cost in this company.The annual financial advantage (disadvantage) for the company as a result of making the motors rather than buying them from the outside supplier would be:

Definitions:

Insourcing

Job creation through foreign direct investment.

Foreign Direct Investment

Investment made by a company or individual in one country in business interests in another country, in the form of either establishing business operations or acquiring business assets.

Market-Entry Strategies

Plans developed by businesses to enter new markets and establish a presence in them.

Global Sourcing

The purchase of materials or services from around the world for local use.

Q1: Excerpts from Aultman Corporation's comparative balance sheet

Q13: If the new bus is purchased, the

Q22: Dukas Corporation's net cash provided by operating

Q26: What would be the financial advantage (disadvantage)from

Q88: What was the Consumer Products Division's residual

Q91: The net cash provided by (used in)investing

Q93: If demand is insufficient to keep everyone

Q94: Last year Burch Corporation's cash account decreased

Q153: Mihok Corporation has provided the following financial

Q198: Priddy Corporation processes sugar cane in batches.The