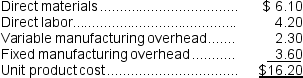

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each.Product A90's unit product cost is $16.20, determined as follows:  Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Social Impact

The effect that individuals, organizations, or activities have on the well-being of a community or society at large.

Confrontational

Inclined toward or characterized by direct, often hostile opposition or challenge.

Consistent

Referring to something that is uniform, steady, or unchanged over time or across situations.

Viable Alternative

A feasible or practical option that serves as a substitute or replacement for something else.

Q23: The simple rate of return on the

Q32: A manager would generally like to see

Q34: Which of the following would be relevant

Q60: (Ignore income taxes in this problem.)The management

Q67: Piper Corporation's standards call for 1,000 direct

Q80: Part U16 is used by Mcvean Corporation

Q126: When computing the project profitability index of

Q158: The delivery cycle time was:<br>A)30.6 hours<br>B)2 hours<br>C)29.4

Q182: Which of the following costs are always

Q420: Bailey Corporation manufactures orange safety suits for