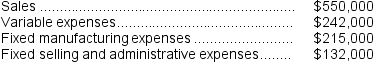

The management of Schmader Corporation is considering dropping product M12C.Data from the company's accounting system appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system.Further investigation has revealed that $137,000 of the fixed manufacturing expenses and $79,000 of the fixed selling and administrative expenses are avoidable if product M12C is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system.Further investigation has revealed that $137,000 of the fixed manufacturing expenses and $79,000 of the fixed selling and administrative expenses are avoidable if product M12C is discontinued.

Required:

a.What is the net operating income earned by product M12C according to the company's accounting system? Show your work!

b.Determine the financial advantage (disadvantage)for the company of dropping product M12C.Should the product be dropped? Show your work!

Definitions:

Cost Of Goods Manufactured

The total manufacturing costs of goods that are completed and ready for sale within a specific accounting period.

Manufacturing Overhead

All manufacturing costs that are not directly traceable to a product, including costs associated with running the production facility.

Work In Process

Products that are in the middle of the production process and are not yet completed; represents a component of inventory on the balance sheet.

Finished Goods

Goods that are completed production and are now available for customer acquisition.

Q4: The raw materials quantity variance for the

Q7: The net cash provided by (used in)operating

Q28: The net cash provided by (used in)operating

Q74: The net cash provided by (used in)financing

Q93: (Ignore income taxes in this problem.)The following

Q142: The internal rate of return is computed

Q148: The amount shown for revenue in the

Q208: The selling and administrative expenses in the

Q277: The variable overhead efficiency variance for October

Q429: Loughry Catering uses two measures of activity,