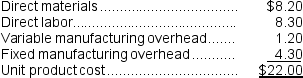

Sardi Inc.is considering whether to continue to make a component or to buy it from an outside supplier.The company uses 17,000 of the components each year.The unit product cost of the component according to the company's cost accounting system is given as follows:  Assume that direct labor is a variable cost.Of the fixed manufacturing overhead, 70% is avoidable if the component were bought from the outside supplier.In addition, making the component uses 2 minutes on the machine that is the company's current constraint.If the component were bought, time would be freed up for use on another product that requires 4 minutes on this machine and that has a contribution margin of $7.00 per unit.

Assume that direct labor is a variable cost.Of the fixed manufacturing overhead, 70% is avoidable if the component were bought from the outside supplier.In addition, making the component uses 2 minutes on the machine that is the company's current constraint.If the component were bought, time would be freed up for use on another product that requires 4 minutes on this machine and that has a contribution margin of $7.00 per unit.

When deciding whether to make or buy the component, what cost of making the component should be compared to the price of buying the component?

Definitions:

Promissory Estoppel

A legal principle that prevents a party from withdrawing a promise made to a second party if the latter has reasonably relied on that promise to their detriment.

Personal Liability

The legal responsibility of an individual to satisfy debts or obligations from their personal assets when they cannot be met through insurance or other protections.

Corporate Ship

An unofficial term possibly referring to a company or a corporation operating in a global or international market, navigating through business waters.

Duty to Disclose

A legal obligation requiring a party to reveal important information to another, often seen in contracts and dealings.

Q36: If the present bus is repaired, the

Q47: (Ignore income taxes in this problem.)Crowl Corporation

Q76: Moselle Corporation has provided the following financial

Q91: What is the financial advantage (disadvantage)for the

Q102: What is the financial advantage (disadvantage)of Alternative

Q116: If the salvage value of equipment at

Q121: CoolAir Corporation manufactures portable window air conditioners.CoolAir

Q123: Fixed costs should not be ignored when

Q203: Danny Dolittle makes crafts in his spare

Q421: Elliott Corporation makes and sells a single