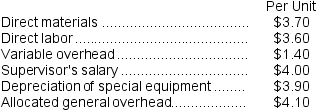

Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 7,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:

An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

-If management decides to buy part U98 from the outside supplier rather than to continue making the part,what would be the annual financial advantage (disadvantage) ?

Definitions:

Free Nerve Endings

Sensory nerve fibers that extend into the tissues and open on the surface or just below, responsible for sensing pain, temperature, and touch.

Sensory Receptor

Specialized cells or cell parts that detect external or internal stimuli and transmit signals to sensory neurons.

Deep Pressure

A type of tactile input that is firm and usually applied to larger areas of the body, often used therapeutically to promote relaxation and decrease stress.

Light Touch

is a sensory perception triggered by a stimulus that lightly contacts the skin, allowing for the detection of texture, pressure, and vibration.

Q20: Excerpts from Neuwirth Corporation's comparative balance sheet

Q32: (Ignore income taxes in this problem.)Boxton Corporation's

Q61: The direct labor in the planning budget

Q122: How many minutes of milling machine time

Q135: Residual income should be used to evaluate

Q139: The salvage value of new equipment should

Q141: Return on investment (ROI)equals margin multiplied by

Q175: Eliminating nonproductive processing time is particularly important

Q325: Wadding Corporation applies manufacturing overhead to products

Q376: The spending variance for occupancy expenses in