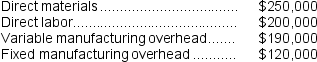

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

-If Melbourne decides to purchase the subcomponent from the outside supplier,the annual financial advantage (disadvantage) would be:

Definitions:

Future Value

The worth of an asset or cash on a specific future date that is equal in value to a certain amount today.

Interest Rate

The proportion of the main amount that is charged by the creditor for borrowing their money, or the interest earned on funds that are deposited.

Payments

Transactions involving the transfer of money from one party to another as a form of compensation for goods, services, or obligations.

Future Value

The projected value of an investment or an asset at a specific date in the future, taking into account factors like interest rates or returns.

Q21: Comparative balance sheets and the income statements

Q26: Ignoring the annual benefit, to the nearest

Q29: Foto Company makes 50,000 units per year

Q45: An investment project with a project profitability

Q83: The residual income for this year's investment

Q101: In a special order situation that involves

Q148: The residual income for the Hum Division

Q160: Information on four investment proposals is given

Q271: The amount shown for "Employee salaries and

Q430: Sharifi Hospital bases its budgets on patient-visits.The