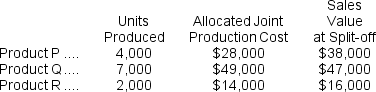

Bowen Company produces products P, Q, and R from a joint production process.Each product may be sold at the split-off point or be processed further.Joint production costs of $81,000 per year are allocated to the products based on the relative number of units produced.Data for Bowen's operations for the current year are as follows:  Product P can be processed beyond the split-off point for an additional cost of $10,000 and can then be sold for $50,000.Product Q can be processed beyond the split-off point for an additional cost of $35,000 and can then be sold for $65,000.Product R can be processed beyond the split-off point for an additional cost of $6,000 and can then be sold for $25,000.

Product P can be processed beyond the split-off point for an additional cost of $10,000 and can then be sold for $50,000.Product Q can be processed beyond the split-off point for an additional cost of $35,000 and can then be sold for $65,000.Product R can be processed beyond the split-off point for an additional cost of $6,000 and can then be sold for $25,000.

Required:

Which products should be processed beyond the split-off point?

Definitions:

Hyperinflations

Extremely high and typically accelerating inflation rates, leading to a rapid erosion of the real value of local currency.

Inflation Tax

The revenue the government raises by creating money

Deadweight Loss

The fall in total surplus that results from a market distortion, such as a tax.

Money-Supply Growth Rate

The rate at which the amount of money available in an economy grows, impacting inflation and economic activity.

Q3: On the statement of cash flows, the

Q9: Supler Corporation produces a part used in

Q51: The use of return on investment (ROI)as

Q94: The required rate of return is the

Q111: The net operating income in the planning

Q120: (Ignore income taxes in this problem.)The management

Q139: Tanouye Corporation keeps careful track of the

Q210: The materials quantity variance for November is:<br>A)$3,880

Q248: Amirault Manufacturing Corporation has a standard cost

Q294: The materials quantity variance for August is:<br>A)$10,980