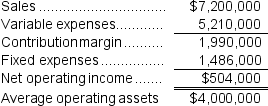

Wolley Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

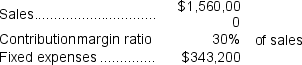

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year, would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Definitions:

Arguments

A series of statements or reasons presented to persuade others that an assertion is true or valid.

Oak

A genus of trees and shrubs known for their strength, longevity, and distinctive leaves and acorns.

Maple Trees

Deciduous trees belonging to the genus Acer, known for their distinctive leaf shapes and the production of maple syrup and timber.

Green Leaves

A phrase that often refers to the common appearance of leaves due to the presence of chlorophyll, which is crucial for photosynthesis.

Q1: The materials price variance for January is:<br>A)$2,482

Q12: (Ignore income taxes in this problem.)The management

Q32: (Ignore income taxes in this problem.)Boxton Corporation's

Q44: What is the financial advantage (disadvantage)for the

Q77: Perkins Corporation is considering several investment proposals,

Q105: If the new product is added next

Q144: If the company pursues the investment opportunity,

Q204: The labor efficiency variance for February is:<br>A)$650

Q304: Doby Corporation makes a product with the

Q426: The standards for product G78V specify 4.1