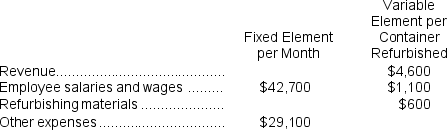

Herlocker Corporation is a shipping container refurbishment company that measures its output by the number of containers refurbished.The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes.  When the company prepared its planning budget at the beginning of February, it assumed that 26 containers would have been refurbished. The amount shown for revenue in the planning budget for February would have been closest to:

When the company prepared its planning budget at the beginning of February, it assumed that 26 containers would have been refurbished. The amount shown for revenue in the planning budget for February would have been closest to:

Definitions:

Excise Taxes

Taxes imposed on specific goods, such as tobacco and alcohol, often intended to reduce consumption or generate revenue.

Marginal Tax Rate

The tax rate paid on an additional dollar of income.

Taxable Personal Income

The portion of an individual's earnings that is subject to taxation, after accounting for deductions and exemptions.

Proprietary Income

Income generated from owning a business or holding exclusive rights to a product or service.

Q10: Schapp Corporation keeps careful track of the

Q11: Sade Inc.has provided the following data concerning

Q49: The labor rate variance for July is:<br>A)$764

Q76: The raw materials price variance for the

Q126: When recording the direct labor costs in

Q136: Banfield Corporation makes three products that use

Q222: The spending variance for direct materials in

Q277: The variable overhead efficiency variance for October

Q379: Cryan Jeep Tours operates jeep tours in

Q433: The variable overhead rate variance for June