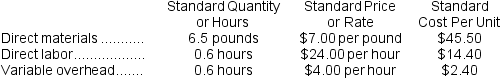

Kartman Corporation makes a product with the following standard costs:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor rate variance for June is:

Definitions:

Fully Depreciated

An asset's state when it has amortized or written off its entire initial cost over its useful life, leaving it with a book value of zero or minimal value.

Asset

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide future benefit.

Life Estimate

A projection or approximation of the duration or longevity of an entity, product, or component.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity.

Q17: Throughput time is the amount of time

Q81: Last year's return on investment (ROI)was closest

Q125: The variable overhead rate variance is:<br>A)$14,280 F<br>B)$13,314

Q141: Rodarta Corporation applies manufacturing overhead to products

Q333: Westby Urban Diner is a charity supported

Q339: The variable overhead rate variance is:<br>A)$1,000 Favorable<br>B)$1,000

Q346: The net operating income in the planning

Q348: Creger Corporation, which makes landing gears, has

Q392: Hamiter Framing's cost formula for its supplies

Q441: The labor efficiency variance for November is:<br>A)$700