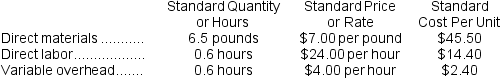

Kartman Corporation makes a product with the following standard costs:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for June is:

Definitions:

Coupon

A coupon is the interest payment made to bondholders, usually on an annual or semi-annual basis.

Market Rate of Interest

The prevailing rate at which interest is paid by borrowers for accessing funds in the financial market.

Selling For

The process or act of offering goods or assets for sale at a particular price.

Normal Yield Curve

When the yield curve slopes upward, it is said to be “normal,” because it is like this most of the time.

Q10: Schapp Corporation keeps careful track of the

Q19: Which of the following would not be

Q49: The labor rate variance for July is:<br>A)$764

Q49: When recording the direct labor costs, the

Q100: Mike Corporation uses residual income to evaluate

Q119: The fixed component of the predetermined overhead

Q191: The administrative expenses in the planning budget

Q340: What is ChocO's labor rate variance?<br>A)$902 Favorable<br>B)$2,880

Q365: The administrative expenses in the planning budget

Q395: The following information relates to the direct