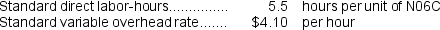

Freytag Corporation's variable overhead is applied on the basis of direct labor-hours.The company has established the following variable overhead standards for product N06C:  The following data pertain to the most recent month's operations during which 1,600 units of product N06C were made:

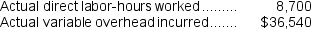

The following data pertain to the most recent month's operations during which 1,600 units of product N06C were made:  Required:

Required:

a.What was the variable overhead rate variance for the month?

b.What was the variable overhead efficiency variance for the month?

Definitions:

Split-Off Point

The stage in production at which multiple products derived from a common input process become separately identifiable, and costs are then attributed accordingly.

Joint Products

Products that are produced from the same process or raw materials, often with little to no variation in cost until the split-off point, where they may be further processed differently.

Net Realizable Value Method

An accounting method used to value inventory or accounts receivable at the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation.

Market Value at Split-Off Method

A method used to allocate joint costs based on the market value of products at the point of separation in a production process.

Q8: Craycraft Inc.reported the following results from last

Q46: If the denominator level of activity is

Q52: Eagan Corporation manufactures one product.The company uses

Q114: The labor rate variance for the month

Q162: Bartoletti Fabrication Corporation has a standard cost

Q167: The cost of December merchandise purchases would

Q190: The budgeted required production for May is

Q194: Murie Corporation makes one product and has

Q329: The spending variance for equipment depreciation for

Q407: During September, Ferman Clinic budgeted for 3,800