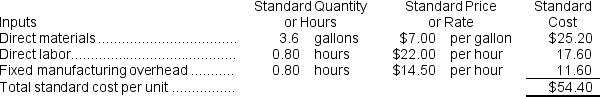

Platko Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year, 38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year, 38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded, which of the following entries will be made?

Definitions:

Liabilities

Financial obligations or debts that a company owes to others, which must be settled over time through the transfer of economic benefits including money, goods, or services.

Capital Structure Decisions

Strategic choices made by a firm regarding the mix of financial securities, such as debt and equity, to optimize its funding and operational goals.

Shares Of Stock

Units of ownership in a corporation or financial asset, providing a proportion of the profit to shareholders in the form of dividends.

Q23: The personnel expenses in the planning budget

Q28: When the company closes its standard cost

Q33: Fabbri Wares is a division of a

Q33: When recording the direct labor costs in

Q50: Kiker Incorporated makes a single product--an electrical

Q57: Stefanovich Corporation makes one product.The company has

Q109: Obenshain Corporation manufactures one product.The company uses

Q187: Bluemel Air uses two measures of activity,

Q219: The spending variance for equipment depreciation for

Q411: The direct materials in the flexible budget