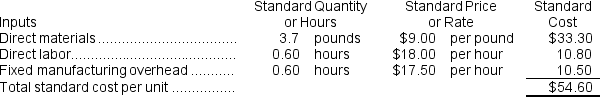

Scogin Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:  During the year, the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.

During the year, the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production, the Work in Process inventory account will increase (decrease) by:

Definitions:

Income Taxes

Taxes imposed by a government on the financial income generated by all entities within their jurisdiction.

Cash Flow

The inflow and outflow of cash representing the operating activities of an organization.

Working Capital

The difference between a company's current assets and current liabilities, indicating operational liquidity.

Straight-Line Depreciation

A procedure for apportioning the expenditure of a tangible good across its viable life in consistent annual amounts.

Q84: The raw materials quantity variance for the

Q90: Catano Corporation pays for 40% of its

Q112: The fixed overhead volume variance is:<br>A)$52,195 U<br>B)$65,195

Q122: The basic idea underlying responsibility accounting is

Q129: Bialas Corporation uses a standard cost system

Q151: Gregorich Incorporated makes a single product--a critical

Q198: The expected cash collections for February is

Q303: The variable overhead rate variance for January

Q352: The materials quantity variance for February is:<br>A)$3,277

Q450: Fixed costs should usually be included in