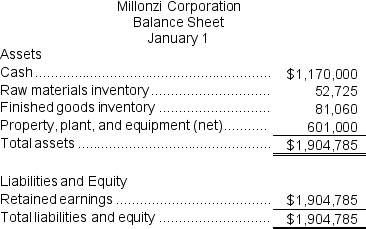

Millonzi Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The company's balance sheet at the beginning of the year was as follows:  The standard cost card for the company's only product is as follows:

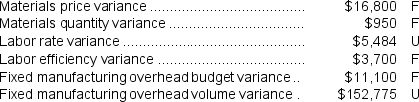

The standard cost card for the company's only product is as follows:  The company calculated the following variances for the year:

The company calculated the following variances for the year:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $236,250 and budgeted activity of 13,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $236,250 and budgeted activity of 13,500 hours.

During the year, the company completed the following transactions:

a.Purchased 21,000 liters of raw material at a price of $8.70 per liter.

b.Used 19,510 liters of the raw material to produce 5,300 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 4,570 hours at an average cost of $19.70 per hour.

d.Applied fixed overhead to the 5,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $225,150.Of this total, $165,150 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $60,000 related to depreciation of manufacturing equipment.

e.Transferred 5,300 units from work in process to finished goods.

f.Sold for cash 5,500 units to customers at a price of $108.90 per unit.

g.Completed and transferred the standard cost associated with the 5,500 units sold from finished goods to cost of goods sold.

h.Paid $27,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

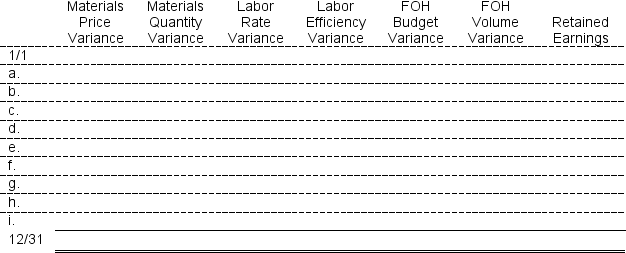

1.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet, it is in two parts.In your text, these two parts would be joined side-by-side to make one very wide worksheet.

2.Determine the ending balance (e.g., 12/31 balance)in each account.

Definitions:

18th Century

The century spanning the years 1701 to 1800, marked by significant historical events, including the Enlightenment, the American Revolution, and the beginnings of the Industrial Revolution.

19th Century

The period from January 1, 1801, to December 31, 1900, characterized by major social, economic, and technological changes.

Public Policy

Public policy consists of the system of laws, regulatory measures, courses of action, and funding priorities by a governmental entity or its representatives.

Government Outsourcing

The practice of government agencies contracting external organizations or companies to provide services or perform tasks that were previously done by public employees.

Q30: When recording the raw materials purchases in

Q99: Which of the following will usually be

Q124: Pooler Corporation is working on its direct

Q193: A manufacturing company that produces a single

Q208: A manufacturing company that produces a single

Q217: Capes Corporation is a wholesaler of industrial

Q232: If the total budgeted selling and administrative

Q336: The net operating income in the flexible

Q383: The spending variance for "Other expenses" for

Q451: Tuton Memorial Diner is a charity supported