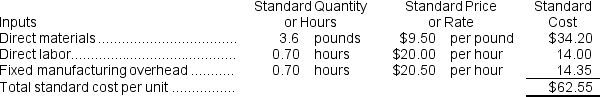

Dalgleish Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $358,750 and budgeted activity of 17,500 hours.During the year, 32,900 units were started and completed.Actual fixed overhead costs for the year were $347,350.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $358,750 and budgeted activity of 17,500 hours.During the year, 32,900 units were started and completed.Actual fixed overhead costs for the year were $347,350.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded, which of the following entries will be made?

Definitions:

Cross-Examination

The interrogation of a witness by the opposing party in a court of law, following the initial examination.

Mediation

A form of alternative dispute resolution where a neutral third party helps the disputing parties to reach a mutually acceptable agreement.

Arbitration

is the process of resolving disputes outside courts, where a neutral third party makes a decision after hearing both sides.

Trial

A formal examination of evidence before a judge, and typically a jury, in order to decide guilt in a case of criminal or civil proceedings.

Q19: Reade Incorporated makes a single product--an electrical

Q21: When applying fixed manufacturing overhead to production

Q22: The revenue variance for May would be

Q31: The spending variance for "Travel expenses" for

Q77: If skilled workers with high hourly rates

Q84: The budgeted cash receipts for October would

Q102: Hykes Corporation's manufacturing overhead includes $4.40 per

Q111: The net operating income in the planning

Q136: Likes Incorporated makes a single product--a cooling

Q170: The administrative expenses in the planning budget