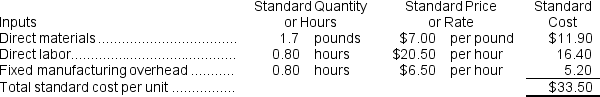

Lemke Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:  During the year, the company started and completed 12,300 units.Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.

During the year, the company started and completed 12,300 units.Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded, which of the following entries will be made?

Definitions:

Qualitative Performance Metrics

Measures used to evaluate the quality aspects of an organization's performance, such as customer satisfaction or employee engagement, that are not easily quantified.

Measure Map

Arrows added to the balanced scorecard showing the expected relationships among performance metrics.

BSC Initiative

A strategic planning and management system that organizations use to communicate what they are trying to accomplish, align the day-to-day work that everyone is doing with strategy, prioritize projects, products, and services, and measure and monitor progress towards strategic targets.

Strategic Objectives

Long-term goals that a company aims to achieve, which help guide the direction and decisions of the organization towards its broader mission.

Q20: The total amount of manufacturing overhead applied

Q82: What did Tantanka use as a predetermined

Q99: The predetermined overhead rate is closest to:<br>A)$21.00

Q100: The fixed overhead budget variance is:<br>A)$20,000 U<br>B)$400

Q124: Pooler Corporation is working on its direct

Q140: The standard direct labor-hours allowed for the

Q171: The estimated net operating income (loss)for February

Q190: The spending variance for "Other expenses" for

Q344: The variable overhead rate variance for indirect

Q413: The selling and administrative expenses in the