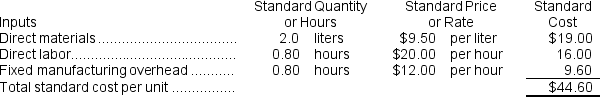

Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.

During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.

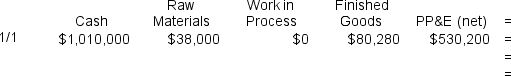

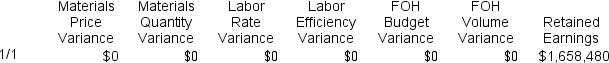

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease) by:

Definitions:

Dieting

The practice of eating in a regulated manner to achieve or maintain a controlled weight.

Anorexia Nervosa

A serious psychological and eating disorder characterized by an extreme fear of weight gain and a distorted body image, leading to restricted food intake and excessive weight loss.

Teenage Girls

Female individuals who are in the age range of 13 to 19 years old, going through various physical, emotional, and social changes.

Teenage Boys

A demographic group defined by males typically aged between 13 to 19 years, undergoing physical, emotional, and psychological development.

Q4: The raw materials quantity variance for the

Q23: The personnel expenses in the planning budget

Q37: Johanson Corporation uses a standard cost system

Q43: The facility expenses in the flexible budget

Q95: When reconciling variable costing and absorption costing

Q99: Tsosie Corporation makes one product and it

Q175: The company plans to sell 39,000 units

Q187: Which of the following budgets are prepared

Q226: Hayworth Corporation has just segmented last year's

Q353: Mansour Memorial Diner is a charity supported