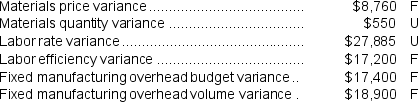

Woodhead Inc. manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $37.45. During the year, the company produced and sold 24,400 units at a price of $47.40 per unit and its selling and administrative expenses totaled $92,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:

-When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease) by:

Definitions:

Neuromuscular Junction

The point of contact between a motor neuron and the muscle fiber it controls, crucial for muscle contraction.

Axon Terminal

The endpoint of a neuron's axon where neurotransmitters are released to send signals to other neurons or muscles.

Motor End Plate

A specialized area of muscle cell membrane that interacts with a motor neuron to receive neural signals, facilitating muscle contraction.

Fascicle

A fascicle is a bundle of skeletal muscle fibers surrounded by connective tissue, contributing to the muscle structure.

Q1: The materials price variance for January is:<br>A)$2,482

Q7: Platko Corporation manufactures one product.It does not

Q10: The selling and administrative expense budget of

Q21: The "Travel expenses" in the flexible budget

Q64: The variable overhead efficiency variance for the

Q83: The fixed component of the predetermined overhead

Q88: The variable overhead efficiency variance is:<br>A)$1,645 F<br>B)$2,121

Q131: Sobus Corporation manufactures one product.It does not

Q198: The expected cash collections for February is

Q212: If the company estimates that it will