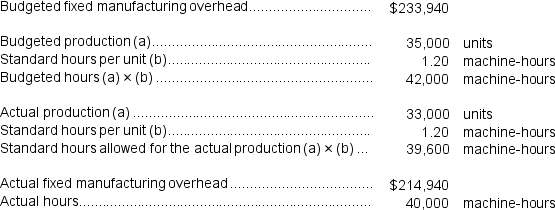

Surma Incorporated makes a single product--a critical part used in commercial airline seats.The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period.Data concerning the most recent year appear below:  The fixed component of the predetermined overhead rate is closest to:

The fixed component of the predetermined overhead rate is closest to:

Definitions:

Net Working Capital

The difference between a company's current assets and its current liabilities, indicating the short term liquidity of a company.

Net Capital Spending

This refers to the amount spent by a company on acquiring or maintaining fixed assets, such as equipment or buildings, after accounting for depreciation.

Average Tax Rate

The percentage of total income that is paid in taxes, calculated by dividing the total tax amount by the total income.

Capital Gains

The profit from the sale of an asset or investment when the selling price exceeds the purchase price.

Q13: Newbery Corporation manufactures one product.It does not

Q72: If the denominator level of activity is

Q127: When using segmented income statements, the dollar

Q160: Gusler Corporation makes one product and has

Q166: The total manufacturing overhead is underapplied or

Q203: Corbel Corporation has two divisions: Division A

Q204: A continuous or perpetual budget is a

Q206: Romeiro Corporation is preparing its cash budget

Q258: The variable overhead efficiency variance for July

Q304: Doby Corporation makes a product with the