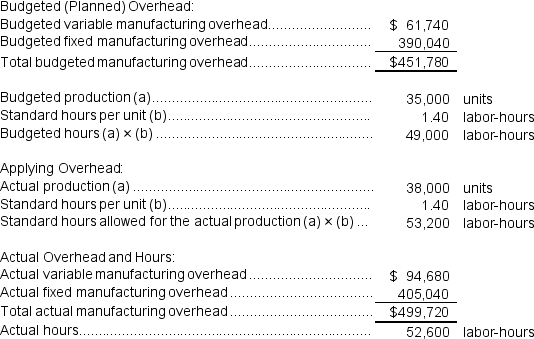

(Appendix 10A) Vaden Incorporated makes a single product--a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

-The total manufacturing overhead is underapplied or overapplied by how much?

Definitions:

Marginal Benefit

The increase in satisfaction or utility gained from consuming one additional unit of a good or service.

Tax Cost

The financial charge or burden imposed by governments on individuals or organizations in the form of taxes.

Majority Vote

A decision-making process in which the option that receives more than half of the votes wins.

Marginal Benefits

The additional satisfaction or utility gained from consuming or producing one more unit of a good or service.

Q87: The net operating income (loss)under absorption costing

Q92: The total manufacturing overhead is underapplied or

Q132: Siciliano Corporation manufactures one product.The company uses

Q139: When recording the direct labor costs, the

Q165: Holl Corporation has provided the following data

Q185: If 66,850 pounds of raw materials are

Q201: The net operating income (loss)under variable costing

Q208: A manufacturing company that produces a single

Q232: The labor efficiency variance for the month

Q342: Galeazzi Corporation makes a product with the