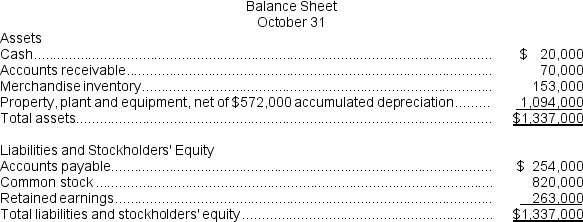

Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:

o Sales are budgeted at $340,000 for November, $320,000 for December, and $310,000 for January.

o Collections are expected to be 80% in the month of sale and 20% in the month following the sale.

o The cost of goods sold is 75% of sales.

o The company would like to maintain ending merchandise inventories equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

o Other monthly expenses to be paid in cash are $24,000.

o Monthly depreciation is $15,000.

o Ignore taxes.

-Expected cash collections in December are:

Definitions:

Relevant Range

The range of activity within which assumptions made about cost behavior are valid. Beyond this range, fixed and variable cost patterns may change.

Break-even Point

The level of sales or production at which total revenues equal total costs, resulting in neither profit nor loss.

Contribution Margin

The selling price of a product minus the variable cost per unit, used to cover fixed costs and contribute to net profit.

Fixed Costs

Expenses that do not change with the level of production or sales activities within a short time.

Q29: What is the net operating income for

Q36: The ending balance in the Work in

Q52: Fernstrom Corporation has two divisions: East and

Q77: Wala Inc.bases its selling and administrative expense

Q109: The expected cash collections for February is

Q111: A company has a standard cost system

Q125: The variable overhead rate variance is:<br>A)$14,280 F<br>B)$13,314

Q127: The following information relates to Mapfes Manufacturing

Q156: The net operating income (loss)under variable costing

Q199: Rameriz Corporation is a shipping container refurbishment