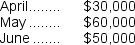

Marty's Merchandise has budgeted sales as follows for the second quarter of the year:

Cost of goods sold is equal to 70% of sales. The company wants to maintain a monthly ending inventory equal to 120% of the cost of goods sold for the following month. The inventory on March 31 was below this target and was only $22,000. The company is now preparing a Merchandise Purchases Budget for April, May, and June.

Cost of goods sold is equal to 70% of sales. The company wants to maintain a monthly ending inventory equal to 120% of the cost of goods sold for the following month. The inventory on March 31 was below this target and was only $22,000. The company is now preparing a Merchandise Purchases Budget for April, May, and June.

-The total number of units produced in July should be:

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed, varying according to the amount of income or profit made.

Unrealized Gain

Represents the increase in value of an investment or asset that has not yet been sold for cash.

Commercial Substance

A concept in accounting that a transaction has commercial substance if it significantly changes the economic circumstances of the entities involved.

Joint Venture

A business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task or business activity.

Q29: The estimated selling and administrative expense for

Q37: Johanson Corporation uses a standard cost system

Q43: Moises Corporation manufactures a single product.Last year,

Q65: Fausnaught Corporation has two major business segments--Retail

Q127: When recording the raw materials purchases in

Q133: The difference between cash receipts and cash

Q136: The net operating income (loss)under absorption costing

Q152: The net operating income (loss)under variable costing

Q205: When expressed on a per unit basis,

Q222: What is the company's unit contribution margin?<br>A)$0.45