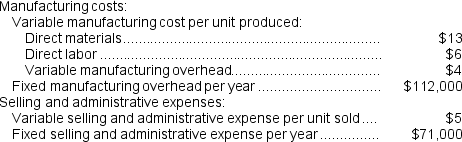

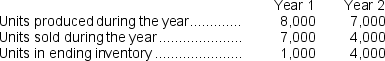

Boylston Corporation has provided the following data for its two most recent years of operation.The company makes a product that it sells for $75 per unit.It began Year 1 with no units in beginning inventory.

Required:

Required:

a.Assume the company uses absorption costing.Compute the unit product cost in each year.

b.Assume the company uses variable costing.Compute the unit product cost in each year.

c.Assume the company uses absorption costing.Prepare an income statement for each year.

d.Assume the company uses variable costing.Prepare an income statement for each year.

Definitions:

Willingness to Pay

The maximum amount a buyer is prepared to spend on a good or service, reflecting the value they derive from it.

Consumer Surplus

The difference between the total amount consumers are willing to pay for a good or service and the total amount they actually pay.

Graphing Calculator

A handheld device capable of plotting graphs, solving simultaneous equations, and performing other tasks with variables.

Consumer Surplus

The deviation between consumers’ anticipated payment for a product or service and the eventual price paid.

Q3: A cost that would be included in

Q14: Gulinson Corporation has two divisions: Division A

Q63: This question is to be considered independently

Q63: The production department of Tarre Corporation has

Q69: Silver Corporation produces a single product.Last year,

Q99: Which of the following will usually be

Q149: The estimated direct labor cost for February

Q172: The amount of cash collected during June

Q174: Hawver Corporation produces and sells a single

Q241: Lefelmann Corporation, which has only one product,