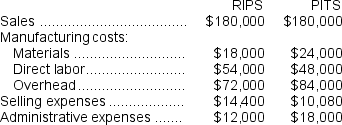

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS.Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible.The following data relate to last month's operations:  $36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products.Use the contribution approach.

Definitions:

Goal-Directed Nursing Care

A systematic nursing approach that focuses on achieving specific outcomes for patients through carefully planned and executed care strategies.

Graphic Record

A visual record or display of data, particularly those relating to time and motion, which can be analyzed or used for further understanding of a process or event.

Progress Record

Documentation detailing a patient's medical history, treatment plans, and health changes over time.

Blood Pressure

The force exerted by circulating blood upon the walls of blood vessels, an essential indicator of cardiovascular health.

Q45: When sales exceed production and the company

Q63: Generally speaking, net operating income under variable

Q70: Using the high-low method, the fixed portion

Q82: What are the equivalent units for conversion

Q112: The unit product cost under absorption costing

Q114: The Werner Corporation uses the weighted-average method

Q128: Shelhorse Corporation produces and sells a single

Q136: Yamakawa Corporation produces and sells a single

Q150: The budgeted sales for February is closest

Q229: The budgeted variable selling and administrative expense