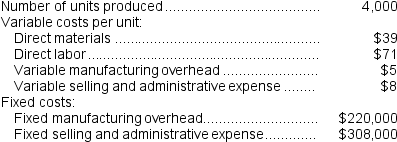

Caruso Inc., which produces a single product, has provided the following data for its most recent month of operations:

There were no beginning or ending inventories.

There were no beginning or ending inventories.

-What is the total period cost for the month under variable costing?

Definitions:

LIFO Conformity Rule

A requirement that if the Last-In, First-Out (LIFO) inventory valuation method is used for tax purposes, it must also be used for financial reporting.

SEC

Securities and Exchange Commission, an independent federal agency responsible for enforcing federal securities laws and regulating the securities industry and stock and options exchanges in the United States.

International Accounting Standards

A set of older accounting standards that were replaced by IFRS, previously developed by the International Accounting Standards Committee (IASC) to guide financial reporting internationally.

FIFO

First In, First Out, an inventory valuation method where the first items produced or acquired are the first ones to be expelled from inventory.

Q5: Tilson Corporation has projected sales and production

Q65: The fixed manufacturing overhead volume variance for

Q99: Which of the following will usually be

Q134: The expected cash collections for May is

Q134: You have just been hired as the

Q137: The volume variance for May is:<br>A)$2,070 U<br>B)$4,140

Q170: Net operating income computed under variable costing

Q188: If the selling price increases by $3

Q211: This question is to be considered independently

Q276: A company has two divisions, each selling