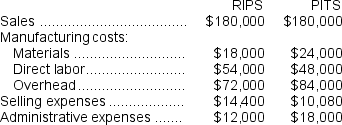

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS.Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible.The following data relate to last month's operations:  $36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products.Use the contribution approach.

Definitions:

Total Assets

The sum of all current and non-current assets owned by an individual or a business entity.

Stockholder's Equity

The residual interest in the assets of a corporation after deducting liabilities, representing ownership interest.

Ratio Analysis

Calculations that measure an organization’s financial health.

Q6: Miller Corporation manufactures a product for which

Q28: If the sales mix were to shift

Q31: Under variable costing, what is McCoy's net

Q103: Carver Corporation produces a product which sells

Q133: Murphy Inc., which produces a single product,

Q149: What is the company's unit contribution margin?<br>A)$0.86

Q174: The manufacturing overhead budget lists all costs

Q188: The unit product cost under absorption costing

Q205: When expressed on a per unit basis,

Q278: Badoni Corporation has provided the following data