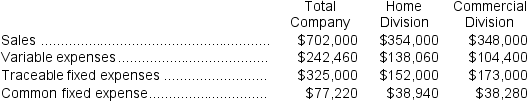

Petteway Corporation has two divisions: Home Division and Commercial Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

Definitions:

Aerobic

Pertaining to or involving oxygen-based exercise that improves the efficiency of the cardiovascular system in absorbing and transporting oxygen.

Muscle-Strengthening

Physical activities and exercises that increase muscle strength, endurance, and mass.

Nutrition Counselors

Professionals specializing in offering guidance and advice on diet and nutrition to help individuals achieve health goals or manage medical conditions.

Physical Activity Planning

The process of designing a structured approach to increase the physical movements or exercises in one's daily routine for health benefits.

Q1: Schuepfer Inc.bases its selling and administrative expense

Q37: In the department's cost reconciliation report for

Q39: The expected cash collections for May is

Q44: Wasilko Corporation produces and sells one product.

Q83: Dukelow Corporation has two divisions: the Governmental

Q110: The Domestic Division's break-even sales is closest

Q126: Poirrier Corporation uses process costing.The following data

Q129: The following data were taken from the

Q129: If a company increases its selling price

Q146: What is the net operating income for