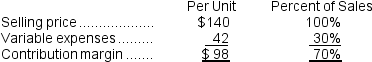

Houpe Corporation produces and sells a single product. Data concerning that product appear below:

Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month. Consider each of the following questions independently.

Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Houpe Corporation.Refer to the original data when answering this question. The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $11 per unit.In exchange,the sales staff would accept a decrease in their salaries of $58,000 per month.(This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units.What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Significance Level

The potential of mistakenly refuting the null hypothesis during a statistical inquiry, typically shown by the alpha symbol.

Significance Level

The threshold used to determine the probability of rejecting the null hypothesis, often denoted by alpha (\(\alpha\)).

Coefficient

In mathematics and statistics, a coefficient is a multiplicative factor in some term of a polynomial, series, or expression; it is usually a number, but in any case does not involve any variables of the series.

Linearly Related

Refers to a correlation between two variables in which a variation in one is linked to a corresponding change in the other.

Q4: Swofford Inc.has provided the following data concerning

Q5: Tilson Corporation has projected sales and production

Q6: The total fixed overhead costs for Blaine

Q24: Last year Easton Corporation reported sales of

Q40: The equivalent units for labor and overhead

Q43: Moises Corporation manufactures a single product.Last year,

Q83: The degree of operating leverage in a

Q106: The total cost transferred from the first

Q148: Dickus Corporation's only product sells for $100

Q204: In activity-based costing, departmental overhead rates are