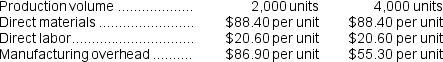

(Appendix 5A) The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:

-The best estimate of the total variable manufacturing cost per unit is:

Definitions:

Legal Taxable Entity

An organization or individual subject to tax laws, with an obligation to file tax returns and pay taxes based on income or transactions.

Shares of Stock

Units of ownership interest in a corporation or financial asset, giving shareholders a claim on part of the company's assets and earnings.

Issuing Stock

The process by which a company distributes shares to investors for the first time, typically to raise capital for expansion or other corporate activities.

Corporation's Resources

The assets, both tangible and intangible, that a corporation has available for use in the production of goods or the provision of services.

Q2: How many units would the company have

Q35: If fixed expenses increase by $10,000 per

Q73: Huitron Inc.expects its sales in September to

Q78: The best estimate of the total cost

Q86: The units in beginning work in process

Q95: The overhead applied to each unit of

Q134: A properly constructed segmented income statement in

Q173: The overhead applied to each unit of

Q175: The activity rate for the General Factory

Q224: Data concerning Wislocki Corporation's single product appear