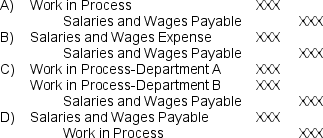

Which of the following journal entries would be used to record direct labor costs in a company having two processing departments (Department A and DepartmentB)?

Definitions:

Depreciation

The method by which a company allocates an asset's cost over its useful life, reflecting the consumption of the asset's economic benefits.

Disposable Income

The reserve of funds households possess for spending and saving after income tax payments.

Savings

The portion of disposable income not spent on consumption of goods and services, set aside for future use.

Disposable Income

Net financial resources for households to allocate towards spending and savings after income taxation.

Q1: The total cost transferred from the first

Q1: Which of the following statements concerning the

Q10: In July, Meers Corporation sold 3,700 units

Q25: Schister Systems uses the following data in

Q37: The cost of a completed unit transferred

Q39: What are the Molding Department's equivalent units

Q91: The cost per equivalent unit for conversion

Q110: The Domestic Division's break-even sales is closest

Q233: Mishoe Corporation has provided the following contribution

Q290: The contribution margin of the South business