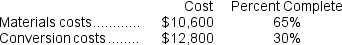

Gunes Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were:

A total of 8,500 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

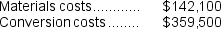

A total of 8,500 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs.

The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The cost per equivalent unit for conversion costs for the first department for the month is closest to:

Definitions:

Financial Soundness

An indication that an entity is stable, solvent, and has the capability to meet its financial obligations.

EDGAR

Stands for Electronic Data Gathering, Analysis, and Retrieval system, a database maintained by the U.S. Securities and Exchange Commission for corporate filings.

Automated Collection

The use of computerized systems to gather debts or receivables efficiently, often used by financial institutions and collection agencies.

Short-swing Profits Rule

A regulation intended to prevent insider trading by requiring company insiders to return any profits made from the purchase and sale of company stock within a six-month period.

Q33: Refer to the T-account below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2627/.jpg"

Q56: Hara Corporation is a wholesaler that sells

Q60: The Richmond Corporation uses the weighted-average method

Q87: Chrzan, Inc., manufactures and sells two products:

Q93: The clerical activity associated with processing purchase

Q146: Veren Inc.produces and sells two products.During the

Q158: The company's overall break-even sales is closest

Q166: If the company allocates all of its

Q170: The overhead applied to each unit of

Q191: If the company's sales increase by 7%,