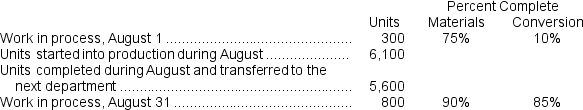

Lenning Corporation uses the FIFO method in its process costing.The following data pertain to its Assembly Department for August.  Required:

Required:

Compute the equivalent units of production for both materials and conversion costs for the Assembly Department for August using the FIFO method.

Definitions:

Conversion Costs

Costs that are incurred to convert raw materials into finished products, typically including direct labor and manufacturing overhead.

Completed Units

The term refers to items that have been fully manufactured, processed, or finished and are ready for sale.

Equivalent Units

A calculation used in process costing to convert partially completed units into a number of fully completed units.

First-In, First-Out

An inventory valuation method where the first items placed in inventory are the first ones to be used or sold.

Q1: Maintenance costs at a Straiton Corporation factory

Q12: The company's degree of operating leverage is

Q14: This question is to be considered independently

Q16: The cost per equivalent unit for materials

Q23: Marston Corporation uses the FIFO method in

Q38: In a scattergraph of cost and activity,

Q46: Herd, Inc., manufactures and sells two products:

Q58: Lucas Corporation uses the weighted-average method in

Q66: Tropp Corporation sells a product for $10

Q96: The following entry would be used to