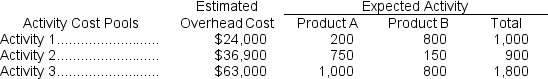

Lindsey Company uses activity-based costing.The company has two products: A and B.The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units.There are three activity cost pools, with estimated total cost and expected activity as follows:  The overhead cost per unit of Product A under activity-based costing is closest to:

The overhead cost per unit of Product A under activity-based costing is closest to:

Definitions:

Destination Contract

A contract specifying that the seller will bear the risk and the cost of delivering goods to a specific location.

Shipment Contract

A contractual agreement where the seller is obligated to transport goods to a specific destination, with risk passing to the buyer when the goods are delivered to the carrier.

F.O.B. Hilltop Farm

A shipping term indicating that the buyer assumes responsibility for the goods once they are shipped from Hilltop Farm.

Intrastate Trucking Company

A company that operates trucks only within the boundaries of a single state, not crossing any state lines.

Q19: Darrow Corporation uses a predetermined overhead rate

Q24: Jersey Corporation has a process costing system

Q32: In calculating cost per equivalent unit under

Q36: How much is the adjusted cost of

Q45: Zubris Corporation uses the FIFO method in

Q48: Nabais Corporation uses the weighted-average method in

Q52: Janner Corporation uses the weighted-average method in

Q92: Lazano, Inc., manufactures and sells two products:

Q97: What total amount of cost should be

Q117: The overhead applied to each unit of